Key Insights:

- Shekel surpasses pre-conflict levels, and the central bank sells $8.2B, demonstrating economic strength and strategic currency defense.

- Israel’s balance of payments remains healthy, showing reduced vulnerability to shocks, even as conflicts persist.

- Debt insurance costs dip, reflecting investor confidence in Israel’s robust economy and effective central bank policies.

The Israeli shekel has showcased a formidable strengthening trend, edging below the levels seen before October 7. The currency’s resilience comes as Israel’s economy navigates through the ripples of recent conflicts, standing as a testament to its underlying strength.

Central Bank’s Strategic Play

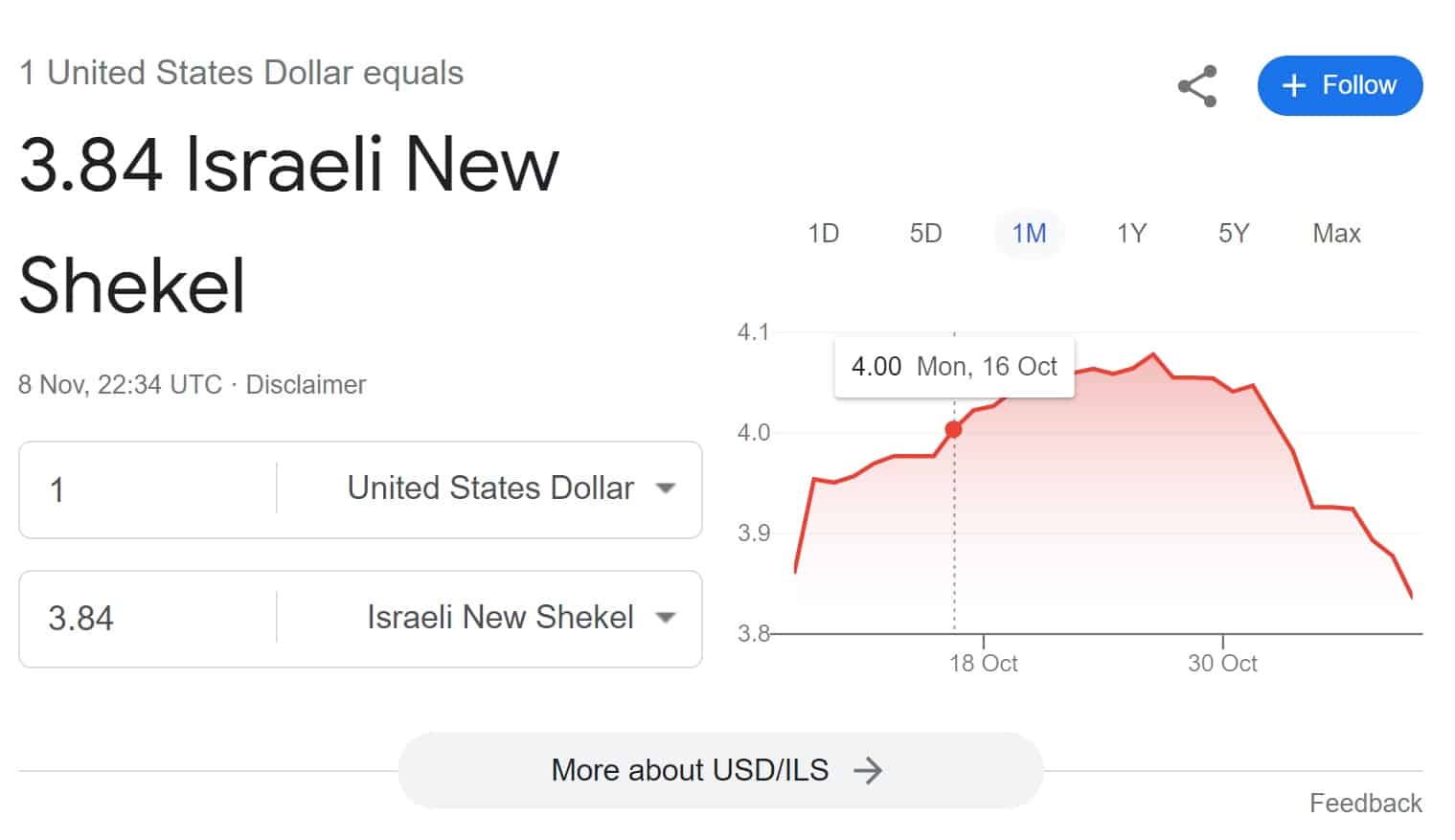

Despite the initial drop in value following the surprise attack on October 7, the shekel has since regained its footing, notably outpacing the dollar. Shekel’s impressive rally to a 0.8% gain against the dollar at 3.8419, outperforming its pre-conflict closure of 3.8461, is a testament to the central bank’s aggressive defense strategy. In October, the bank sold $8.2 billion to stabilize the shekel in response to dipping to an 11-year low the previous month. Consequently, Israel’s foreign reserves were reduced by $7.3 billion, settling at $191.2 billion for the month.

Moreover, the central bank had previously committed to a robust support plan, including the potential sale of up to $30 billion from its reserves and a possible $15 billion through swaps, underscoring its commitment to the shekel’s stability.

Economic Fortitude Amidst Conflict

Despite the backdrop of conflict, Israel’s economic landscape demonstrates considerable fortitude. Analysts Tadas Gedminas and Kevin Daly from Goldman Sachs highlight the country’s balance of payments as “much healthier” than past conflict episodes. This robustness lessens the nation’s vulnerability to economic shocks. Additionally, the economy benefits from considerable financial inflows, including aid during such times of strife.

The central bank’s foreign currency maneuvers were partly balanced by inbound government transfers totaling $2.4 billion. Hence, even as market conditions remain relatively stable, the timing of potential rate cuts will likely depend on the conflict’s intensity and economic impacts.

Credit Strength Maintains Appeal

Further instilling confidence, the cost to insure Israel’s debt against default has decreased, with a 17 basis point retreat this week, although it still hovers above pre-war figures. This reflects a broader sentiment of economic resilience amidst the challenges posed by the conflict.